Leveraging Lab Design in a Shifting Life Science Market: Designing for Adaptability

Flexible and strategic lab design helps life science companies stay competitive, adapt to evolving technologies, and respond quickly to changing market demands. Image: Courtesy of CBT Architects

Life science companies that are looking to expand, contract, or acquire new space need to consider strategic design moves to remain competitive in the midst of today’s market uncertainty. The secret to success in today’s market is to ensure that a company’s physical space will allow lab users to respond quickly to unpredictable requirements, integrate rapidly to evolving technologies, and adapt seamlessly to new initiatives when needed.

At the life science market peak in 2021, lab and office space in Boston/Cambridge, San Diego, and the San Francisco Bay Area was nearly impossible to secure. Tenants were scrambling for any square footage to support their growth, and landlords often had waiting lists before construction was even complete. Tenants often had to make do with what was available, ending up in a less than desirable space with limited infrastructure was not uncommon.

Today, the picture looks very different. Due to an oversupply of lab space, reduced access to venture capital, and shrinking federal funding, vacancy rates in the lab markets continue to climb. For the first time in recent memory, lab tenants are fortunate to have not only options but leverage as well. This shift creates new complexity for both building owners and life science companies seeking space. For companies considering new facilities or modifying their existing facilities, the decisions made during the design process will have an impact on future competitiveness, growth, and talent retention.

Design decisions that influence future competitiveness

Amid cooling markets, life science companies and building owners alike must leverage flexible, technology-ready lab spaces to adapt, differentiate, and turn uncertainty into opportunity. Image: Courtesy of CBT Architects

These three large life science markets may be the most visible examples; they are not alone. Many secondary markets are grappling with similar dynamics as once red-hot markets begin to cool and companies become more selective. Lab design will need to integrate emerging technologies to provide efficient and flexible solutions for end users.

While building owners face the challenge of creating differentiation and ensuring their buildings stand out to attract and retain tenants, life science companies are struggling to adapt to the current economic and political environment. While a few are still looking to find facilities that meet their needs while allowing for future growth, many are finding themselves in a position to adapt their current spaces to fit their changing needs or contract into a smaller building footprint. To succeed, decision-makers must develop a detailed understanding of the spatial and programmatic requirements that drive their business, and when done correctly, this understanding can turn volatility into opportunity.

Emerging technologies drive new design imperatives

Programming and designing for life science space is often complex and challenging. These complexities can quickly multiply when life science companies seek to modernize or alter their facilities to incorporate new approaches in the way they operate that may require advanced infrastructure, smart building technology, sustainability measures, or to simply look for ways to enhance innovation and collaboration among its users. Integrating new and emerging technologies can also complicate matters. Next generation technologies such as AI, machine learning, robots, and automation, to name a few, are quickly changing the way labs are being used.

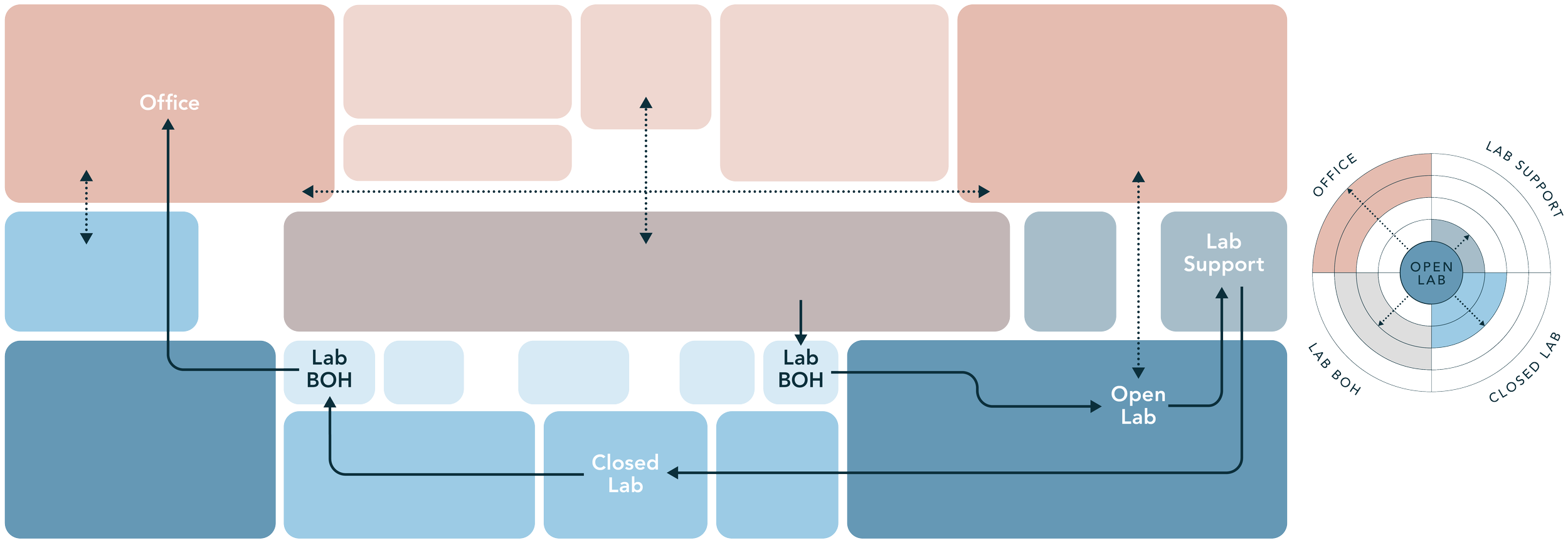

Flexibility and adaptability are now the key buzzwords. Lab users are stressing the need for modular lab designs with movable benches, flexible utilities (e.g., compressed air, gases, water, power), and reconfigurable layouts to accommodate evolving research needs, such as transitioning between wet lab, dry lab, or hybrid setups.

Life science research and development is now integrating AI and advanced technologies to accelerate drug discovery and optimize workflows within the lab. With biologic drugs especially, the large volume of data that is generated from routine procedures for drug development can be difficult to manage.

Whether it is maximizing the quality of advanced imaging and analysis or streamlining the drug candidate screening process, large amounts of data will be involved which will require adequate infrastructure support. This innovative instrumentation may often need robust infrastructure, including enhanced data and telecom capacity, increased electrical requirements, proper ceiling heights, access to specialty gases or a need to work with volatile chemicals.

Designing spaces that attract and retain talent

Effective lab design starts with understanding a company’s growth stage and specialized needs, ensuring spaces support research, retain talent, and keep critical timelines on track. Image: Courtesy of CBT Architects

Life science companies are more than optimized floorplates, rather they are the workplaces of individual people. In down markets, building owners will often seek to provide greater amenities and base building improvements that will help their building tenants attract and retain talent, increase employee satisfaction, and encourage employees to spend more time in the workplace.

As far as lab design is concerned, it’s important to start with a strong understanding of a company’s growth stage. If you are a startup with seed funding, you will have very different design requirements than a late-stage biotech firm preparing for clinical trials or commercial production. For example, early-stage companies often need flexible incubator or accelerator spaces, with modest wet lab footprints, shared amenities, and low overhead. On the other hand, established companies look for build-to-suit opportunities that can accommodate clinical or process manufacturing functions alongside traditional research labs.

Does your business have a sub-market specialty? That can add another layer of complexity to planning as diagnostic laboratories, clinical labs, animal care facilities, and co-working environments demand very specific programmatic needs. These can affect everything from HVAC zoning and floor loading to adjacencies between lab, office, and support functions.

When these unique requirements related to growth phase aren’t identified upfront, you may lose time in finding or adapting space, which can mean missed milestones or delays in critical research. Those delays ripple outward with the potential to have investors lose confidence, clinical timelines slip, and top talent being lured away by competitors with better facilities.

Planning tools that turn insight into action

To navigate this, it’s critical to employ detailed planning frameworks and visual tools to distill fundamentals into clear, actionable insights. This starts with adhering to core lab planning principles that drive infrastructure needs. As companies look to optimize their operations, a tailored spatial needs assessment can clarify needs and creative options to redeploy business R&D needs within your space. Strategic input from design experts that are well-versed in these market trends can optimize your competitive edge when considering any space—including the one you already occupy. It’s also important to define the life science company’s typology and the related space requirements, as well as where the company is in its growth and funding stages. Comprehensive research also needs to be done, including test fits and reviewing case studies that demonstrate how programmatic needs translate into feasible layouts.

Early design planning and strategic fit-outs help life science companies optimize space, support growth, and attract top talent while avoiding costly relocations. Image: Courtesy of CBT Architects

The early use of design tools is key to streamlining the decision-making process. Feasibility test-fits allow companies to evaluate multiple space options against current and projected needs. These studies can highlight whether a building supports future headcount growth, specialized lab functions, or collaboration spaces without forcing costly relocations down the line. For early growth companies, the right fit-out can serve as a growth accelerator and provide an environment that not only supports science but also attracts and retains top talent. Doing more with less square footage frees up capital for strategic redeployment, including human capital and core research needs. For early-stage ventures, clarity around infrastructure and scalability can provide reassurance to investors and leadership. Conversely, the wrong fit-out can slow momentum, make it harder to recruit, and force costly relocations that disrupt both science and culture.

Many of the trends we are seeing in the major life science hubs involve rising vacancy rates, tenant leverage, and the need for differentiation. What the primary real estate markets reveal is how quickly conditions can shift, and how important it is for both developers and tenants to act with clarity and precision.

For example, the growing appeal of spec suites for emerging companies or the importance of flexibility in build-to-suit spaces are lessons that apply to all regions and markets. In markets where demand remains strong, these strategies help buildings stand out and support long-term tenant retention. In newer hubs, they can accelerate cluster formation by lowering barriers for young companies to enter the ecosystem.

The greater Boston life science ecosystem remains one of the most dynamic in the world. While vacancy rates may be rising, demand for fit-out opportunities remains strong, and informed design is the differentiator that helps both building owners and tenants succeed and maintain a competitive edge by being adaptable to ever-changing conditions around them. The lessons emerging in Boston resonate nationally, and life science leaders everywhere can benefit from clarity around their growth stage, typology, and programmatic needs.

The key is to insist on clarity when looking for new space, including a clear understanding of your growth trajectory, defining your lab typology, and demanding feasibility studies before committing. The right space can be a strategic asset, and not just a roof over your research.